Another week and another smaller deposit made to my CapitalOne360 checking account. You know what that means, it is that time of the week for my 52 Week Saving Challenge Week 47 edition! WooT! Though Monday and Tuesday is when I felt my lousiest since getting a cold over week ago, I’m proud to say that today I’m feeling much better. A bit sore, but much better. That’s enough about my stupid cold, let’s get this week recap going.

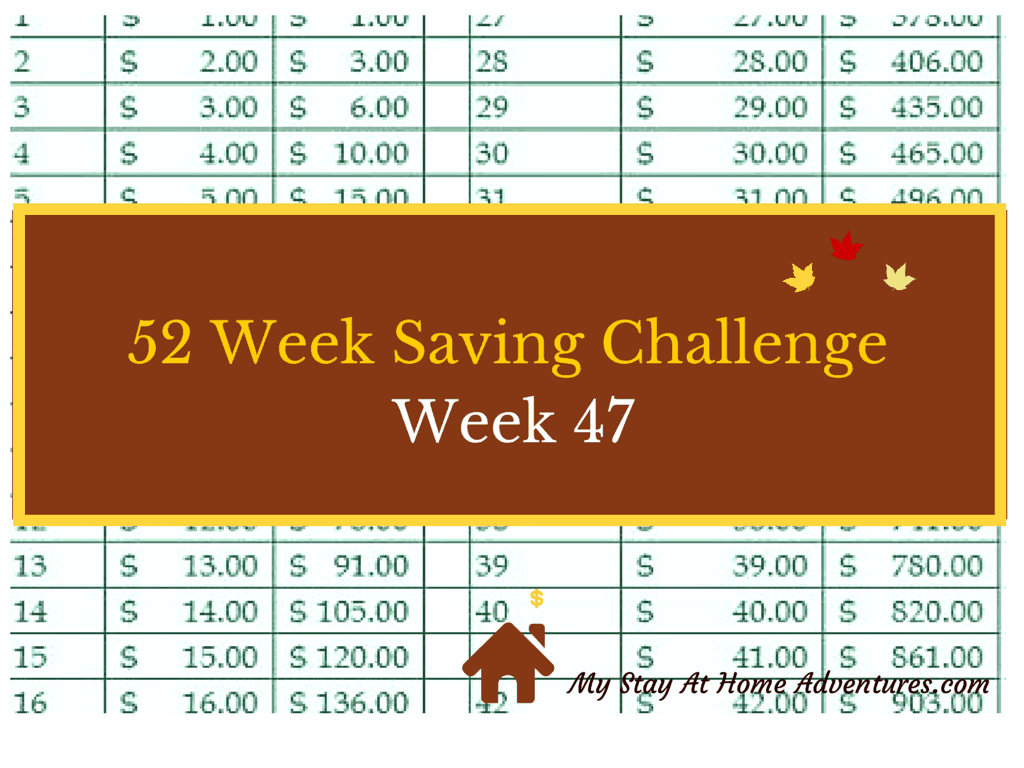

52 Week Saving Challenge Week 47

Week 47 Deposit – $47.00 Total – $1128.00

Week 47 Reverse – $7.00 Total – $1364.00

This Week Recap

Last week, I was very honored and encouraged to have so many of you leave encouraging and positive comments on my 52 Week Saving Challenge weekly progress post. Some of you expressed how you wanted to start this challenge, I encourage you to give it a try because it’s so worth it. My suggestion is to do it the way you want to do it and to not give up. If you need anything, or have any questions, please feel free to contact me.

A few months ago, I expressed in one of my weekly posts how I was thinking of using this saving style for investing or in a Roth Account. A comment from a reader on last week’s post suggested to place the money in a Roth account. I loved it! I think it’s a wonderful idea. It’s something I’m actually excited about and really thinking about it. Thank you, Laurie!

Why I love about this 52 Week Challenge is that it’s personal. As far as what to do with your money you save at the end of this 52 Week Saving Challenge, it is up to you. New couch, emergency fund, vacation, the ideas are endless. The point of the challenge is to to learn to save, save, and making saving a habit.

Yes, how to save. You might laugh but many people don’t know how to save money. Some people have never heard of a personal budget. When you start this challenge, keys to completing this challenge are: planning, budgeting, and executing.

It doesn’t matter if you do this challenge the “regular” way, from $1 to $52 instead of the reverse $52 to $1, you have to budget for the amount you save each week. As the weeks progress, the amount increases, which makes it difficult later during the year (or earlier depending which way you start this challenge). At one point on this challenge, whether you doing it the regular way or reverse way, you are going to have to save over $200 a month!

This is when planning and execution come in handy. When I decided to take on this challenge, I knew that January is the month where I could put aside more money, as oppose to this time of the year (pre-Christmas). So I planned to do this 52 Week Saving Challenge reversed for that reason.

How did I managed to save during the higher transfer weeks? I budget, I cut spending. That’s how I did it. So now it’s much easier to save my weekly saving amount because I am down to almost nothing.

When it comes to finances, planning is key. This is why I recommend this challenge to people; because is not as easy as it looks, but the reward and the skills you learns are so worth it. It reminds me of the time I was killing my debt and becoming debt free.

So there you have a quick recap on how I managed to do this challenge every week for 47 weeks.

Want to join this challenge? Head over here to read all my posts. If you would like to download my 52 Week Saving Challenge file simply click here. I would love to hear how you are all doing with your 52 Week Saving Challenge. If you are a blogger that is doing this challenge we would love to hear from you. Until next week, keep on saving!

The post 52 Week Saving Challenge Week 47 appeared first on My Stay At Home Adventures.